|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Mortgage Rates in Utah: A Comprehensive Guide to Informed DecisionsSecuring the best mortgage rates in Utah can significantly impact your financial future. Whether you're a first-time homebuyer or looking to refinance, understanding the intricacies of mortgage rates is crucial. Understanding Mortgage Rates in UtahMortgage rates in Utah can fluctuate based on various factors, including the economy and personal financial situations. It's essential to stay informed and regularly check the current rates. Factors Influencing Mortgage Rates

Current TrendsAs of now, Utah's mortgage rates are relatively stable, but slight fluctuations are expected. Staying updated on best VA rates today can provide insights into broader trends. How to Secure the Best RatesTo secure the best mortgage rates in Utah, preparation is key. Here are some strategies:

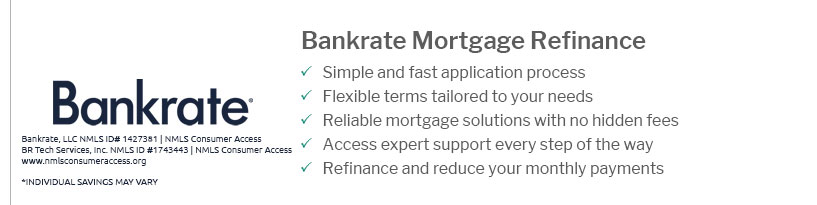

Refinancing and Home EquityRefinancing your mortgage or exploring an equity line of credit rates can also be beneficial for those looking to optimize their mortgage terms. Benefits of RefinancingRefinancing can lower your monthly payments, reduce interest rates, or shorten your loan term. However, it's important to weigh the costs against the potential savings. FAQWhat is the average mortgage rate in Utah?As of the latest data, the average mortgage rate in Utah is around 3.5%, but it can vary based on individual circumstances and market conditions. How often do mortgage rates change?Mortgage rates can change daily based on economic factors, lender policies, and Federal Reserve decisions. In conclusion, understanding and securing the best mortgage rates in Utah requires diligence and informed decision-making. By staying educated on market trends and exploring various options, you can make choices that align with your financial goals. https://www.ufirstcu.com/home-center/rates

Today's Rates ; 30 Year Fixed, 6.375%, 6.666% ; 15 Year Fixed, 6.000%. 6.473% ; 7 Year Fixed, 5.740%, 5.740% ; 5 Year Fixed, 5.490%, 5.490%. https://www.mortgagenewsdaily.com/mortgage-rates/utah

Track live mortgage rates ; 85.2 %. 30 Year Fixed. 1.990%. 3.13%. 6.375% ; 10.5 %. 15 Year Fixed. 1.500%. 2.67%. 4.500% ; 4.3 %. 20 Year Fixed. 1.999%. 3.02%. https://smartasset.com/mortgage/utah-mortgage-rates

Use SmartAsset's mortgage rate comparison tool to compare mortgage rates from the top lenders and find the one that best suits your needs.

|

|---|